How did a small grocery trading business from South Korea grow into one of the world’s most influential tech giants? The answer lies in relentless innovation, bold risks, and a vision that reshaped entire industries.

Founded in 1938, this company started with humble beginnings. Today, it stands as South Korea’s largest conglomerate, dominating global markets in electronics, semiconductors, and telecommunications. Its journey reflects the rapid rise of modern business powerhouses.

Ranked #5 in global brand value in 2024, the firm continues to push boundaries. From smartphones to AI-driven appliances, its products touch millions daily. This article explores how strategic decisions and adaptability fueled its success.

Key Takeaways

- Started as a small trading firm in 1938

- Now South Korea’s top business conglomerate

- Holds the 5th highest global brand value

- Leads in electronics and semiconductor markets

- Success driven by innovation and adaptability

Introduction to the Samsung Story

Few corporations embody national economic transformation like this South Korean powerhouse. The company contributes 22.4% of its country’s GDP, operating 80+ subsidiaries from biopharma to construction. Its growth mirrors South Korea’s rise from post-war poverty to tech leadership.

Central to this success is the chaebol model—a family-led conglomerate driving industrialization. These entities fueled the “Miracle on the Han River,” turning a war-torn nation into a global exporter. Diversification remains key, with electronics generating 59% of revenue alongside heavy industries and insurance.

Leadership has stayed within the Lee family for generations, steering strategic pivots. Today, the firm’s R&D network spans the globe, filing 544 design patents in 2023 alone. This blend of tradition and innovation cements its role as an economic titan.

The Founding of Samsung: 1938-1950

Lee Byung-chul’s humble beginnings in the late 1930s marked the start of an extraordinary business journey. At age 28, he established Mitsuboshi Trading Company in Daegu with just 40 employees. The venture initially dealt in dried fish, noodles, and vegetables—staples of Korea’s local economy.

The Meaning Behind Three Stars

The company’s original name, Mitsuboshi (meaning “three stars” in Japanese), reflected Lee’s ambitious vision. These stars symbolized prosperity, longevity, and strength—values that would guide future expansion. After Korea’s liberation in 1945, the business relocated to Seoul and adopted the Korean pronunciation: Samsung.

Building Korea’s Post-War Economy

Strategic diversification began as the country rebuilt after World War II. Cheil Jedang became Korea’s first sugar refinery in 1953, while Cheil Mojik established textile manufacturing capabilities. These ventures demonstrated early adaptability to market needs.

By 1947, Samsung Mulsan Gongsa emerged as the primary trading arm. The organization shifted focus from basic commodities to value-added production. This pivot toward manufacturing would define its trajectory in the coming decades.

Samsung’s Expansion into Diverse Industries: 1950-1970

Strategic acquisitions and bold ventures defined the conglomerate’s growth in the 1950s-1970s. As South Korea rebuilt post-war, protectionist policies fueled chaebol dominance. The company capitalized on this, weaving a web of interconnected businesses across key sectors.

Textiles and Manufacturing

Cheil Mojik became the backbone of textile production, mastering vertical integration. From raw cotton imports to finished fabrics, it controlled every step. By 1960, the division accounted for 40% of Korea’s textile exports.

Entry into Insurance and Retail

The 1958 purchase of Ankuk Fire & Marine insurance company marked a pivot to financial services. Five years later, Shinsegae department store revolutionized retail with fixed pricing—a first in Korea. These moves diversified revenue streams beyond manufacturing.

Joint ventures in oil refining (1964) and fertilizers aligned with government-led industry goals. Each expansion strengthened the chaebol’s economic influence, setting the stage for future tech dominance.

Samsung Enters the Electronics Industry: 1960s-1970s

The 1960s marked a pivotal shift as the conglomerate ventured beyond traditional industries. South Korea’s government prioritized tech growth, offering tax incentives and infrastructure. This push aligned perfectly with the firm’s ambition to diversify.

First Electronics Divisions

In 1969, Samsung Electronics Devices launched in Suwon. Partnerships with Japan’s Sanyo and NEC provided critical technical expertise. Together, they mastered transistor radio production—a stepping stone to advanced electronics.

Black-and-White Televisions

By 1970, the company produced Korea’s first black-and-white TV. These products combined imported parts with local assembly, cutting costs. Exports to Panama and Vietnam boosted global brand recognition.

Vertical integration became key. The firm controlled every step, from cathode tubes to plastic casings. This manufacturing strategy ensured quality and cost efficiency. Meanwhile, early semiconductor research hinted at future breakthroughs.

The Rise of Samsung Electronics: 1980s

Breaking into the global electronics market required bold investments and cutting-edge research in the 1980s. The company transformed into a tech leader by prioritizing innovation and quality. Its Suwon R&D complex became the hub for breakthroughs, including the 64Mb DRAM chip in 1996.

Focus on Research and Development

The Suwon facility spearheaded research development, outpacing Japanese rivals in memory chips. Engineers perfected DRAM technology, enabling smaller, faster products. Joint ventures with Toshiba (optical drives) and Corning (glass tech) accelerated progress.

Global Manufacturing Facilities

Factories in Portugal (1982), the UK (1987), and the US (1984) boosted manufacturing capacity. The $13B Austin semiconductor plant (1996) cemented its electronics dominance. Strict quality reforms post-1987 ensured consistent excellence across all sites.

Samsung’s Technological Breakthroughs: 1990s

Cutting-edge advancements during the 1990s propelled the company to global leadership. Research spending surged despite economic challenges, yielding innovations that redefined entire industries. This decade cemented its reputation as a technology pioneer.

Memory Chips and Semiconductors

By 1992, the firm became the world’s largest DRAM manufacturer. Process improvements shrank chips from 180nm to 130nm, boosting performance. These memory chips powered computers worldwide, capturing 40% market share.

The Asian Financial Crisis intensified R&D focus rather than slowing progress. Engineers developed stacked capacitor designs that increased chip density. This technical edge outpaced Japanese competitors struggling with recession.

LCD and Display Innovations

Display technology leaped forward with the first 21″ TFT-LCD in 1995. Cross-licensing deals with Sony combined Korean manufacturing scale with Japanese precision. Together they dominated the flat-panel industry.

Vertical integration gave complete control over display products. From glass substrates to final assembly, every component was made in-house. This approach later proved vital for HDTV standardization efforts.

Surviving the Asian Financial Crisis: 1997

The late 1990s tested the resilience of even the strongest corporations, demanding radical restructuring. South Korea’s economy collapsed under $17B in foreign debt, forcing the conglomerate to slash its affiliate count from 59 to 47.

Strategic Downsizing

Non-core businesses like aerospace and vehicles were sold, including Samsung Motor to Renault. Workforce cuts reduced labor costs by 30%, while debt ratios plummeted from 366% to 166%.

Leadership shifts followed Lee Kun-hee’s return, prioritizing profitability over expansion. The company exited volatile market segments, doubling down on semiconductors and telecom.

Focus on Core Businesses

R&D budgets surged for memory chips, securing 40% global share. The Suwon labs accelerated DRAM innovations, outpacing rivals in the industry.

By 2000, streamlined operations stabilized finances. This pivot proved vital for future dominance in mobile and display technologies.

Samsung’s Global Dominance: 2000s

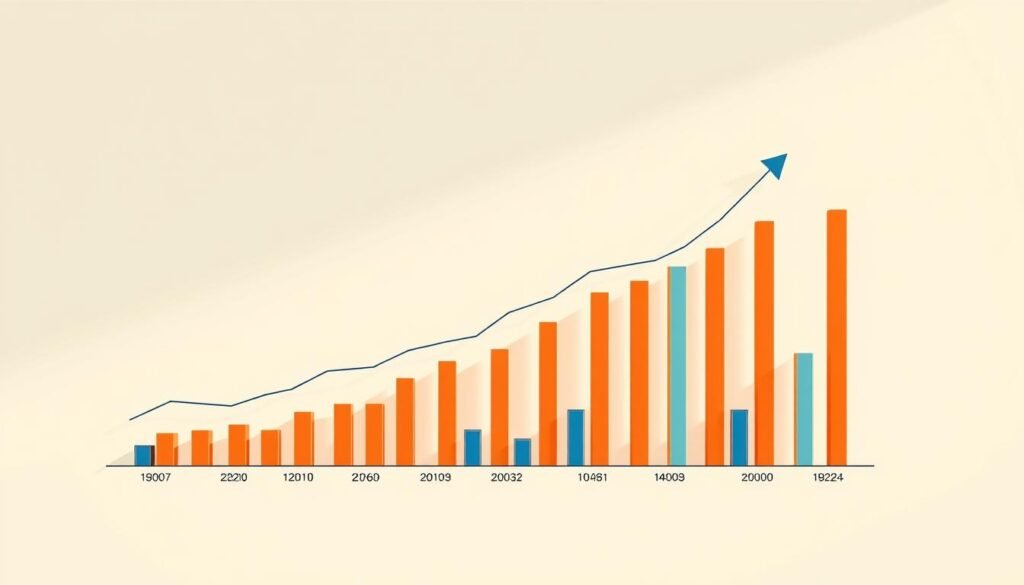

A new era of global influence started with the launch of iconic devices. The 2000s cemented the brand’s reputation as a leader in mobile technology, driven by sleek designs and cutting-edge features. By 2012, its smartphones captured 25.4% of the global market, with over 800 million units produced.

Smartphones and Mobile Revolution

The Galaxy S debut in 2010 redefined consumer expectations. AMOLED displays offered vibrant colors and energy efficiency, outpacing competitors. Carrier deals with Verizon and AT&T expanded U.S. availability, fueling adoption.

Legal battles with Apple, including a $1 billion patent verdict in 2012, highlighted fierce rivalry. Despite setbacks, the company pivoted, refining designs and software. The Bada OS evolved into Tizen, ensuring long-term ecosystem control.

Galaxy Series and Category Creation

The 2011 Galaxy Note invented the phablet category, merging tablets and phones. Its stylus functionality appealed to professionals, carving a niche. Flagship products like the S and Note series drove consistent share growth.

Vertical integration gave the brand an edge. From chipsets to screens, every component was optimized in-house. This strategy ensured quality and cost efficiency, solidifying its market dominance.

Samsung’s Legal and Ethical Challenges

Corporate giants often face scrutiny, and this tech leader’s journey includes significant legal battles. While driving innovation, the company navigated complex patent disputes and governance reforms. These challenges shaped its modern compliance approach.

High-Profile Patent Disputes

The 2010s brought fierce intellectual property wars with Apple. A 2012 case resulted in a $1 billion verdict over smartphone designs. Ongoing battles pushed the firm to develop unique interface features.

Governance and Succession Controversies

Vice Chairman Lee Jae-yong’s 2017 bribery conviction exposed succession planning flaws. The scandal involved $38 million payments to secure government support. Restructuring separated leadership from daily operations post-trial.

The 2016 Note7 recall cost $5.3B after battery fires. It triggered enhanced safety protocols across all product lines. Quality control teams now report directly to the board.

Workplace and Industry Scandals

Worker safety lawsuits emerged from chip plants in 2018. Employees claimed chemical exposure caused illnesses. Settlements included medical monitoring programs.

In 2005, DRAM price-fixing fines totaled $300M. The industry-wide scheme artificially inflated memory chip prices. Compliance training now prevents antitrust violations.

Post-scandals, $200M was invested in ethics programs. Independent directors now hold 50% of board seats. These changes restored market confidence while maintaining share leadership.

Samsung’s Role in South Korea’s Economy

South Korea’s economic landscape remains deeply intertwined with its corporate giants, shaping industries and policies alike. The chaebol system created industrial powerhouses that now anchor the country‘s global competitiveness. These structures account for extraordinary economic metrics while influencing broader societal development.

Structural Power of Conglomerates

Cross-shareholding networks bind subsidiaries to parent companies, creating economic ecosystems. Government policies historically favored this model, offering tax breaks for export-focused business expansion. The system propelled rapid industrialization but also concentrated economic power.

Today, these entities control 15% of the KOSPI index. Their supply chains employ 290,000+ workers directly, with millions more in dependent industries. This vertical integration makes them vital to national employment stability.

Macroeconomic Impact

The conglomerate contributes 20% of South Korea’s total exports, particularly in semiconductors and displays. Its R&D spending equals 4% of the nation’s total research budget, driving technological advancement across sectors.

Small and medium enterprises (SMEs) both benefit and struggle within this system. While chaebols create demand for components, their dominance limits market opportunities for independent firms. Recent reforms aim to balance this dynamic through fair trade regulations.

Economists describe the situation as “too big to fail”—the company’s stability directly affects national security. During crises, its production continuity becomes a government priority, highlighting unique corporate-national interdependence.

Samsung’s Diversified Business Portfolio

From ocean-going vessels to life-saving drugs, the company’s portfolio defies conventional categorization. While electronics dominate public perception, its businesses span sectors that power modern civilization. This diversification provides stability against market fluctuations in any single industry.

Heavy Industries and Shipbuilding

Samsung Heavy Industries ranks as the world’s second-largest shipbuilder, constructing 15% of global LNG carriers. Its Geoje shipyard engineers cutting-edge offshore platforms for deep-sea oil extraction. These floating structures withstand Category 5 hurricanes while drilling at 3,000-meter depths.

The division holds 22% market share in marine engines, powering container ships worldwide. Advanced dual-fuel models reduce emissions by 40% compared to traditional designs. Such innovations maintain competitiveness against Chinese and Japanese rivals.

Biopharmaceuticals and Healthcare

A $2.1 billion investment since 2011 built a formidable biotech arm. Bioepis leads in biosimilars, with copycat versions of Humira and Enbrel generating $780M annually. These drugs offer affordable alternatives to expensive biologic treatments.

Joint ventures with GE Healthcare produce MRI and CT scanners combining Korean manufacturing with American imaging tech. The partnership recently launched AI-powered diagnostic services that analyze scans 30% faster than conventional systems.

Contract research operations support 140 clinical trials annually across 15 countries. This industry footprint demonstrates how diversified capabilities create unexpected synergies between industrial and life science sectors.

Samsung’s Research and Development Prowess

Global dominance in tech isn’t accidental—it’s built on relentless R&D investment. With 54 research centers worldwide, the company files 544 design patents annually. Its 65,000+ active patents reflect a culture where innovation thrives.

Global R&D Centers

From Silicon Valley to Bangalore, labs specialize in information technology and hardware. The Suwon facility leads semiconductor breakthroughs, like Exynos chipsets. These power flagship devices with unmatched efficiency.

Collaborations with MIT and Stanford drive 6G research. Trials achieve speeds 50x faster than 5G. Such advancements cement leadership in next-gen connectivity.

Innovation in AI and 5G

The Samsung Advanced Institute pioneers AI, acquiring Viv Labs for voice assistant tech. Bixby now integrates with smart home ecosystems. Quantum computing labs explore error correction for commercial use.

In biotech, genetic engineering merges with diagnostics. AI-powered services analyze medical scans, reducing diagnosis times. Cross-industry R&D ensures every sector benefits from technology leaps.

Samsung’s Environmental and Social Initiatives

Beyond tech innovation, the company has made sustainability a core pillar of its operations. Its RE100 pledge aims for 100% renewable energy by 2050, backed by a $20B semiconductor eco-investment. Over 1 million youth gained tech skills through its global training programs.

Sustainability Efforts

Solar cell recycling programs recover 95% of materials from used panels. Advanced filtration in semiconductor fabs reclaims 75% of water—critical for drought-prone regions.

Disability-friendly product lines include braille-compatible smartphones. These cater to an underserved market while driving inclusive design standards.

Corporate Social Responsibility

During COVID-19, the firm donated ventilators and PPE to 23 countries. Its art sponsorships preserve cultural heritage, funding 120+ exhibitions annually.

By merging business goals with societal needs, the brand sets benchmarks for the industry. Its healthcare services, like AI diagnostics, further bridge tech and human welfare.

Samsung’s Future: 2024 and Beyond

The next decade will redefine how we interact with technology, and this tech giant is at the forefront. With breakthroughs like 2nm chips and 6G networks, its roadmap blends precision engineering with bold market ambitions. Here’s how it plans to lead the charge.

Next-Gen Technologies

Mass production of 2nm semiconductors begins in 2025, promising 45% faster processing at reduced power. These chips will power everything from AI servers to autonomous vehicles. Partnerships with Tesla and BMW aim to dominate the automotive silicon market.

Foldable displays target 40% global adoption by 2027. New hinge designs and ultra-thin glass make screens more durable. Meanwhile, XR headsets merge virtual and physical worlds for immersive consumer experiences.

Market Expansion Strategies

Africa emerges as a key growth region, with localized products like solar-powered fridges and budget smartphones. Nigeria and Kenya will host new R&D hubs to tailor solutions for emerging economies.

Premium smart appliances integrate AI for personalized services, like refrigerators that order groceries. Private 5G networks for factories boost automation, cutting production costs by 30%. Each move reflects a strategy to innovate while diversifying revenue streams.

The Samsung Story: Lessons in Innovation

Corporate resilience often emerges from navigating turbulent waters, and few firms exemplify this better than the South Korean tech giant. Its journey offers five key insights for business leaders navigating today’s volatile markets.

Crisis management became an art form during the 1997 Asian Financial Crisis. The company slashed debt ratios by 55% while doubling R&D spending—a counterintuitive move that secured semiconductor dominance. This pattern repeated during the Note7 recall, transforming product safety protocols.

Vertical integration delivers both power and peril. Controlling supply chains from chips to screens ensures quality but requires massive capital. When display market demand shifts, these investments can become burdens rather than advantages.

Leadership transitions reveal structural vulnerabilities. The 2017 governance case exposed succession risks in family-led conglomerates. Reforms now separate ownership from operations while maintaining strategic vision continuity.

Global success demands local adaptation. While R&D centers span continents, regional hubs tailor products to cultural preferences. Vietnam factories serve Southeast Asia, while Texas plants focus on North American demand cycles.

Sustained innovation requires betting big on future technologies. The firm allocates 8.5% of revenue to R&D annually—triple the industry average. This funds moonshot projects like quantum computing alongside incremental improvements.

Conclusion

From wartime rebuilding to AI supremacy, this South Korean powerhouse reshaped global tech. Its 86-year journey proves adaptability beats initial scale—from noodles to nanotech.

The company now navigates chip wars and AI races while balancing its business ecosystem. Geopolitics pose risks, especially in semiconductor supply chains.

Future success hinges on mastering AI-driven technology without over-relying on Android. Sustainable innovation remains key in a volatile market.

FAQ

When was Samsung founded and by whom?

The company was established in 1938 by Lee Byung-chul as a small trading firm in South Korea. It initially dealt in groceries and dried fish before expanding into other industries.

How did the company transition into electronics?

In the late 1960s, the firm entered the electronics industry by producing black-and-white TVs. This marked the beginning of its journey toward becoming a global tech leader.

What role did the Asian financial crisis play in reshaping the business?

The 1997 crisis forced the conglomerate to restructure, focusing on core areas like semiconductors and mobile devices. This strategic shift strengthened its market position.

What are some key innovations from Samsung Electronics?

Breakthroughs include advanced memory chips, OLED displays, and the Galaxy smartphone series. Its R&D investments have driven progress in AI, 5G, and foldable screens.

How does the company contribute to South Korea’s economy?

As part of the chaebol system, it significantly impacts GDP, exports, and employment. Its subsidiaries span shipbuilding, insurance, and biotechnology.

What sustainability initiatives has the corporation undertaken?

Efforts include reducing carbon emissions, using recycled materials in products, and supporting renewable energy projects through its environmental programs.

What challenges has the brand faced legally?

Issues include patent disputes with Apple and corporate governance controversies. These cases have influenced its operational and leadership policies.

What future technologies is Samsung investing in?

Current priorities include quantum computing, advanced semiconductors, and AI-driven healthcare solutions to maintain its competitive edge.